About Us

Capital-A is an early-stage venture capital fund investing in manufacturing, deep tech, and climate. We back founders building from the ground up — from advanced hardware to other patient-capital businesses that demand conviction and time. Now deploying from its $50 million Fund II (Category II AIF), Capital-A combines a private-equity mindset with venture agility, partnering closely with founders to scale sustainably through deep operational expertise, industry networks, and a long-term commitment.

Investment Philosophy

Core Belief

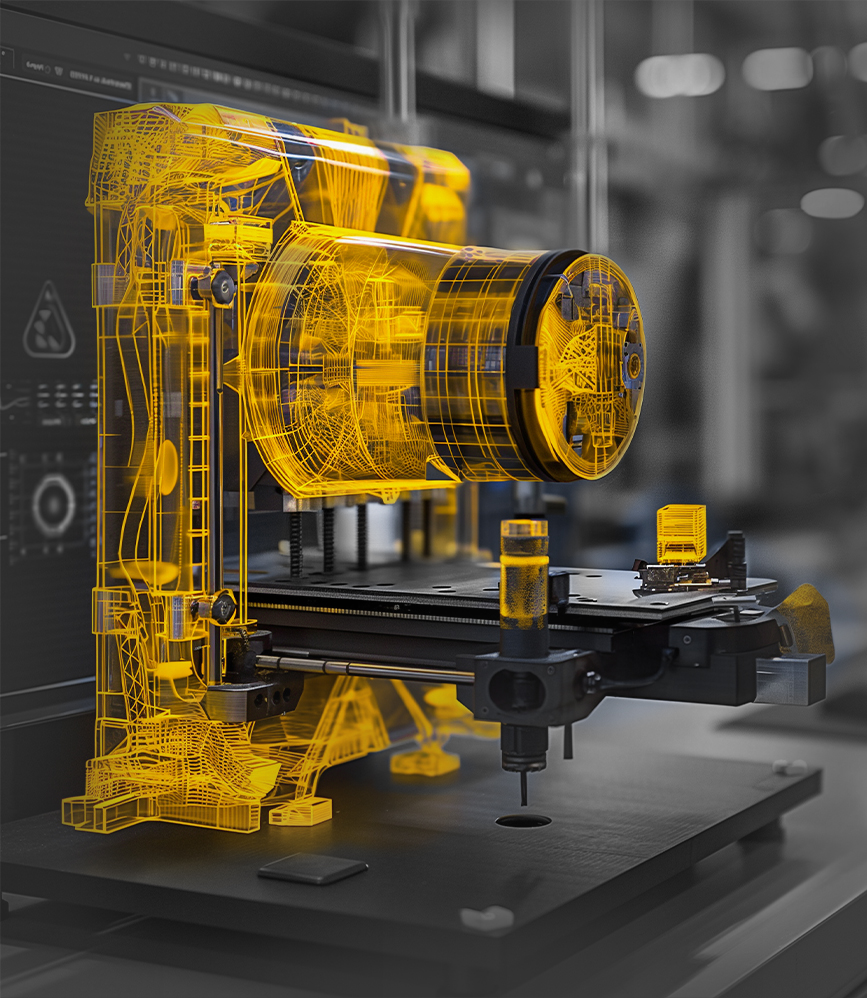

The next few decades of growth will come from the industrial corridors and shopfloor of India – founders re-engineering how the country builds its hardware economy. Capital-A backs this new generation of manufacturing-first entrepreneurs who blend engineering, technology, process discipline, and global ambition to build tangible businesses.

Where we invest

We invest in early-stage ventures across manufacturing and its adjacencies – from advanced hardware and industrial Al to materials and clean technologies. Our view of deep tech and manufacturing goes beyond R&D – we believe patient capital should back founders who aim to build sustainable, revenue-driven businesses that create long-term value.

Investment Size & Stage

We invest ₹5–12 Cr ($500K–$1.5M) in early-stage companies. We prefer to be the first institutional investors, but also co-lead or co-invest alongside other believers who share our conviction in building enduring, value-driven businesses.

Our Approach:

VC Agility × PE Discipline

We move with early-stage speed but invest with long-term conviction through active board involvement and patient partnership.

Thematic Investing

Our focus stays on clear themes across manufacturing and its adjacencies — in deeptech, climate, and technology.

Flexible Participation

We prefer to lead or co-lead rounds, and co-invest alongside others when we can’t add exponential value ourselves.

Engagement

We stay hands-on — helping founders refine operations, hiring, and go-to-market strategies (without the jargon).

Network

We open doors — to investors, industry leaders, and global conferences and exhibitions, helping founders take their technologies from India to the world.

EQ

We lead with empathy — building trust-based relationships and balancing board roles with emotional intelligence. Having lived the founder journey, we understand it deeply.

Our Legacy

Capital-A’s foundation is built on the legacy of Manjushree Technopack, South Asia’s largest rigid packaging manufacturer. Over four decades, the Kedia family partnered with global brands such as Unilever, Nestlé, Reckitt Benckiser, Coca-Cola, GSK, and Tata, operating over 15 manufacturing plants across India. Through its journey with PE Funds like Kedaara Capital and Advent International, Manjushree set benchmarks in value creation, with landmark divestment exercise . That hands-on experience — of building, operating, and exiting a market-leading manufacturing enterprise — shapes Capital-A’s DNA today: combining deep operational experise to India’s next generation of industrial entrepreneurs.

Initiatives

Climathon is Capital-A’s joint initiative with Java Capital—the world’s first 24-hour pitch fest for climate startups. Held annually since 2022, it brings together visionary founders, investors, and experts to accelerate breakthrough ideas in clean energy, sustainability, and circular innovation. The initiative has also led us to invest in several outstanding climate startups driving real impact.

Maxcel—an amalgamation of manufacturing and excellence—is Capital-A’s yearly acceleration program designed to discover underrated manufacturing startups, mentor and fund them, and strengthen India’s manufacturing economy through early-stage capital. The first edition in 2025 was a massive national success, spotlighting deep-tech and industrial ventures building globally scalable products from India.